The Challenge

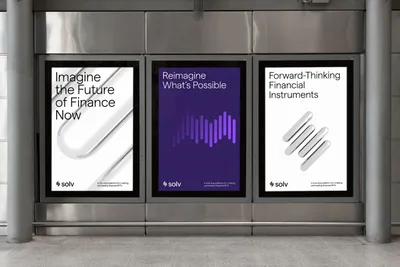

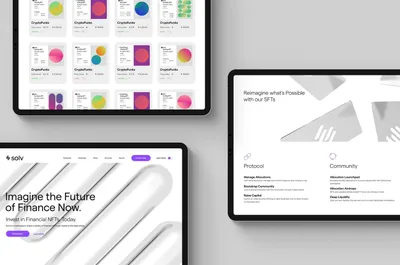

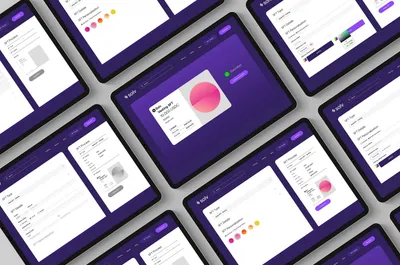

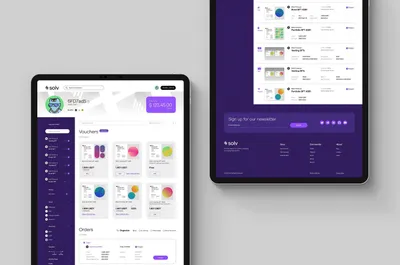

Solv came to us for a full rebrand of their visual identity, seeking a visual system to unify their offering and products. The goal was to transition from a cool, young, and fun image to one that is reliable, top-tier, and high-tech.

As Solv grows and its users become more savvy in DeFi, the brand needed a change to reflect its reliability and technological innovation.